The problem: Water shortage in China

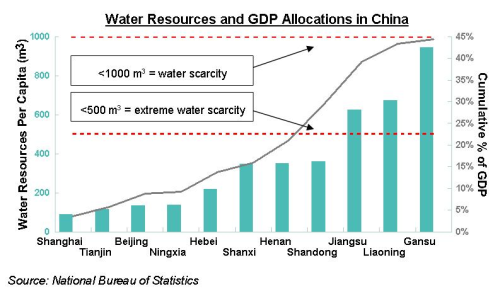

At 90L/day, China’s water consumption per capita is only around one-sixth of the US. But as the world’s largest fresh water consumers by volume, having consumed over 1.3 trillion m3 of fresh water in 2012, compared to the 800 billion m3 by the US, China’s thirst for water will only increase as the country continues to grow. While the water-rich, southern regions are able to remain largely self-sufficient in their water needs, most of the drier northern regions are already facing large water deficits. As Figure 2 illustrates, these problematic regions are also responsible for close to half of the Chinese industrial output. This has led to drastic undertakings by the central government, such as the controversial South–North Water Transfer Project, to help alleviate the persistent water shortage faced by the north.

With the passing of the 12th 5-year plan, the central government is shifting focus from maximising GDP growth, to achieving a sustainable rate of growth that will focus on the protection and sustainable management of vital resources. Part of this plan will involve limiting provincial water usage through annual quotas assigned by the central government. However, with the rapid growth in domestic consumption from the rising middle class, water usage will only increase as industrial output continues to grow. Although traditional water treatment methods such as Advanced Oxidation Processes (AOP), Sequencing Batch Reactors (SBR) or Electrodeionisation (EDI), often require a smaller initial capital outlay, these methods also contain operational drawbacks compared to the use of membranes. These include the need for continuous input of expensive chemical reagents in AOP systems or the large energy consumption in EDI systems, leading to much higher operating costs in the long-run. Therefore, it is likely that water dependant industrial users will adopt new water recycling technologies incorporating filtration membranes, over the use of these traditional systems, to help manage their water consumption needs.

In response to the expected growth potential in this industry, GCiS has recently published a report on the Chinese membranes market. Based on in-depth, first-hand field research with the top membranes suppliers in China, this report provides a comprehensive overview of the current state of the membranes market and its development over the next few years.

The product: Filtration membranes

Much like the West, the Chinese membranes market is comprised of four major product segments. Categorised in terms of their pore sizes, from the largest to smallest, the four major filtration membrane segments are: microfiltration (MF), ultrafiltration (UF), nanofiltration (NF) and reverse osmosis (RO). Although the biggest industrial application of filtration membranes is in water production and treatment, the ability to provide an efficient way of separating particles from various fluids has brought the use of filtration membranes into various industrial applications, such as filters for blood dialysis machines, protein separation in food or drug manufacturing, clarification of juices and the production of vaccines or antibiotics.

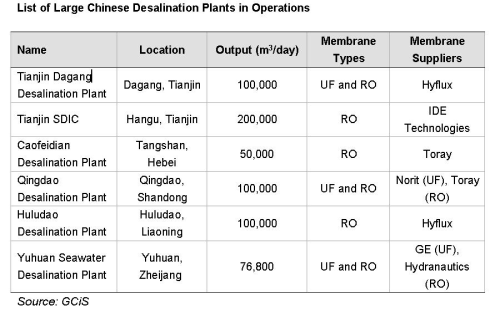

Of the four product types, UF and RO membranes represent the two largest segments, benefiting from their widespread usage in various water treatment applications, such as desalination. Although China has only begun implementing desalination technologies on a large scale in the past 15 years, it is playing an increasingly important role as an alternative source of fresh water resource for the northern parts of country. More importantly, these new operations are relying almost exclusively on RO membrane filtration technology, along with UF membranes being used by some operators as part of the pre-treatment process.

This is because, when compared to traditional methods such as distillation or ion exchange, RO membranes offer a more cost-effective alternative, due to their lower power consumption levels. Furthermore, they are also not restricted by the design and output limitations stemming from processes relying on green, renewable energy such as geothermal or solar desalination. Although the current production cost of desalinated water is about RMB 5-8 per cubic metre (m3), higher than the current delivery price of RMB 4/m3 for municipal tap water, it is still much cheaper than the expected delivery cost of around RMB 10/m3 for the South-North project. Given the consistent persistent water shortage issue in the northern coastal regions, desalination looks to be one of most attractive options in alleviating these chronic water shortages.

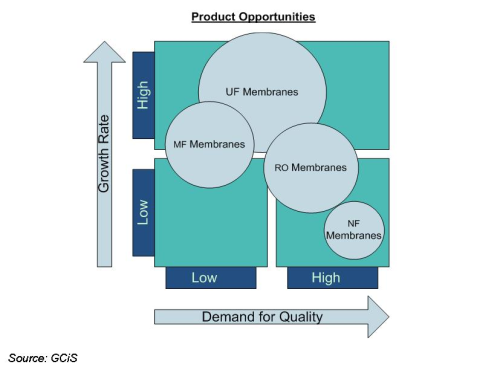

MF membranes are the third largest product segment, although they are regularly used by western countries in the municipal water treatment market, this practice has yet to become widely adopted by China; most of the current demand for this type of membrane is still limited to industrial uses, particularly the food and beverage and pharmaceutical sectors. NF membranes only represent a small portion of the membranes market, as they are mainly used in specialised industrial applications, where there is a need for ultra-pure water. The geographical distribution of membrane sales is concentrated in the industrialised northern, eastern and southern regions of China, where there is a large manufacturing presence; these three regions account for approximately 70% of the total membrane market revenues.

The Market: Foreign versus domestic manufacturers

| The Chinese membrane market structure can be broken down into two distinct markets, each with their own unique characteristics |

The first category is comprised of the UF and MF segments; these are part of a more fragmented market, with a large number of smaller Chinese suppliers. The more technologically-advanced manufacturing process needed to produce RO and NF membranes, has led to these two segments being dominated by a few large, mostly foreign firms; leading to a much more concentrated market.

Furthermore, these foreign suppliers have elected to import membranes from their overseas manufacturing facilities, rather than choosing to produce them domestically.

Across all four product segments, competition between foreign and domestic firms exists in a number of ways. These include foreign firms offering a higher quality imported product, with domestic firms competing by offering lower priced alternatives.

Through the use of large distributors, and having the brand recognition stemming from being part of well-known international manufacturing conglomerates such as GE or Siemens, foreign suppliers are able to reach a much larger share of the Chinese market.

This stands in contrast to smaller Chinese suppliers, who rely more heavily on local demand from the regions surrounding their manufacturing operations.

Growing trends: Developments within the Chinese membranes market

The membranes market has undergone some noticeable changes in recent years. With the rapid adaptation of membrane technologies by the water production and supply industry, sales revenue from this sector has grown from less than 8% of the total market in 2010, to about 26% in 2012. With their widespread usage in the various water treatment processes, growth in the UF and MF segments has far outpaced the RO and NF segments.

The competitive advantages of having superior technologies, better quality products and brand recognition, held by foreign suppliers is beginning to slip and with it so does their market share. As Figure 4 shows, while 63% of the market revenues were being held by foreign firms in 2010; their market share has fallen to around 40% in 2012. This can also be attributed, in part, to the increasing popularity of UF and MF membranes, as these two types of membranes are mainly produced by domestic suppliers. This trend is likely to persist, barring any major technological breakthrough from the foreign suppliers, as domestic suppliers will only become increasingly more dominant as they continue to improve and invest in the development of better products and manufacturing processes.

The road ahead: Sustained growth spurred by strong demand

Looking ahead, there will plenty of demand for RO and NF membranes from specialised industrial end-users. However, revenue growth from the UF and MF segments is likely to continue to outperform the other segments over the coming years. As water resources remain one of the main focuses in the current 5-year plan, the central government has earmarked RMB 4 trillion for the continued build-up of water infrastructure and other water related projects through to 2020. These investments will not only help alleviate the water shortage in northern China, but with a focus on the sustainable management and protection of water resources, associated industries will reap the benefits from these massive infrastructure investments. •

Futher information:

Steven Li, Analyst

GCiS China Strategic Research

Tel: +86 10 59789950 (Ext. 832)

E-mail: steven.li@gcis.com.cn

GCiS is a China-based market research and advisory firm focused on business to business markets. Since 1997, GCiS has been working with leading multinationals in sectors ranging from technology to industrial markets, medical, chemicals, resources, building and constructions and other sectors.